Investing in the Western Cape

Economic development in the Western Cape is characterised by a broad sector base,

with good growth potential in several major sectors, a range of significant niche

sectors and a number of large new investment projects.

Rapidly decreasing communication cost levels mean the disadvantages of Cape Town's

distance of 1 500 kilometres south of the economic hub of Gauteng and several

thousand kilometres from European, American and Asian centres is less and less

significant.

In line with worldwide trends, South Africa's export-oriented industries tend to shift

towards port cities and coastal industrial belts - the drop in import duties and the

establishment of Saldanha Steel as a basis for Western Cape heavy industry add more

momentum to this shift.

The Western Cape has an open economy with foreign trade making up close to 30% of

the gross regional product. The province's exports have traditionally been dominated

by primary products such as fruit, fish and

vegetables, but with beneficiation adding

increasingly higher value.

Wesgro

Wesgro

Wesgro is the official investment and trade promotion agency for the Western Cape,

the first point of contact for foreign importers, local exporters and investors wanting

to take advantage of the business potential of Cape Town and the province as a

whole.

The agency works closely with key players such as the South African government,

business, labour, the City of Cape Town, district

municipalities and rural local

authorities. Its key objectives are:

- To market the economic potential, the advantages and investment opportunities

of the Western Cape, both within South Africa and internationally.

- To maintain and increase economic momentum and confidence in the Western

Cape.

- To gain recognition for the Western Cape as a dynamic development region.

Key projects

In the regional development of the Western Cape a number of large investment

projects have lately played an important role in maintaining growth and employment

momentum.

Some major projects are currently in the process of implementation, with ample

opportunities for further investments in each of these cases. These include the Cape

Town International airport, Cape Town central station, jewellery emporium, Kudu Gas

(Cape Power Project), perlemoen (abalone) project,

Philippi east town centre,

refrigerated container plant, Robben Island gateway centre, Roggebaai canal, Sandy

Cove and the Zeconi optical fibre plant.

Tourism

The Western Cape's beauty is unsurpassed and it is a top international tourist

destination. Some 50% of international tourists arriving in South Africa visit the

Western Cape, while the overall share of the region in South Africa's tourism market

is

approximately 24% by gross expenditure.

Estimates for the different components of the Western Cape's 8-million annual tourists

clearly show the dominance of local tourists – 46% from other provinces and 39%

from inside the Western Cape - as compared to 14.3% foreign tourists. In the latter

category, tourists from elsewhere in Africa have reached about half the number of

foreign arrivals.

The tourism industry is a major growth sector in terms of investment, employment

and the diversification of services. Less directly, tourism stimulates the property

market - especially prime residential and cluster projects – and strengthens business

contacts, often are the forerunners of trade, joint ventures and immigration plans.

Agriculture and fishing

The

sheltered valleys between mountains are ideal for the cultivation of export-grade

fruit such as apples, table grapes, olives, peaches and oranges. A variety of

vegetables is cultivated in the eastern part of the Western Cape, while the wheat-

growing Swartland and Overberg districts are the country's breadbasket.

The agricultural sector is critical for the Western Cape economy, accounting for 60%

of regional exports. Since the 1990s the sector has steadily expanded, with only

moderate fluctuations due to late winter rains, shifting world market prices and other

unforeseeable factors related to specific product segments.

South Africa's 300-year-oldwine industry is based in the south of the province. The

region produces 3.1% of the world's wine and ranks as number nine in overall volume

production, with 100 200 hectares under vines for wine production.

Some 75% of all South African fishing taking place along the Western Cape coastline.

The rich fishing

grounds on the west coast are protected from exploitation by a 200km

commercial fishing zone and a strict quota system. Snoek, Cape lobster, abalone,

calamari, octopus, oysters and mussels are among the delicacies produced in these

waters.

Key exports are also fruit, wine, wool and ostrich. The high quality of exports,

combined with the relative weakness of the local currency, makes the products some

of the most affordable high quality exports in the world.

Manufacturing

In the past the strength of Cape manufacturing largely depended on the performance

of the food processing sector as well as clothing and textile industries. Several other

segments made relatively small, yet significant contributions to the sector, like the

petrochemical and plastics industry, furniture, printing and publishing.

The establishment of the R9-billion Saldanha Steel Project (SSP) is expected to

gradually expand the base of Western Cape industry, helping create downstream

processing plants. The rise of information technology, telecommunications, medical

and research equipment and other hi-tech processes will further broaden the industrial

core of the Western Cape. The Capricorn Science and Industrial Park in the beach

town of Muizenberg one of a number of catalysts.

Financial services

Cape Town is the second largest financial centre in the country. The province has in

the past relied largely on the insurance industry as the backbone of this sector.

While this sector still expands, a stronger momentum seems to come from the

establishment of new, specialised financial service suppliers in the area, either as

branches of Gauteng head office, or as a shift of certain of the activities to the more

attractive working environment of the Cape. This trend includes foreign firms, and

new investment groups focusing on the local investment scene.

Parallel to the steady expansion of financial services and retailing, dominated by the

expansion of a few retail mega-centres, there is also a boom in professional,

business, property and personal services. In particular the property services sector

has experienced dramatic growth.

Business process

outsourcing

A rapidly expanding sector showing good potential in the Western Cape in particular is

business process outsourcing, which includes the processing of accounts and claims,

as well as front office activities such as call centres. This growth is fuelled by world-

class service levels of call centre staff, time-zone compatibility with Europe, high

rates of fluency in English coupled with neutral English accents, a favourable exchange

rate and an advanced telecommunications industry.

Investment agency Calling the Cape has facilitated call centre deals in the Western

Cape worth R933-million since the beginning of 2004, with investments in 2005 up by

19% over 2004. Some 79% of this investment originated from the UK, with companies

from Canada, Germany, the Netherlands and the US also represented.

Companies running call centres in the Western Cape include Barclays, JP Morgan,

Lufthansa, the Budget Group, Merchants/Asda, Dialogue and STA Travel.

Research published in November 2004 by independent analysts Datamonitor predicted

that South African call centre numbers would double by 2008 - and rated Cape Town

ahead of India for quality of service.

Download the Department of Trade and Industry's

Provincial Economic

Overview (1.8 MB)

here.

SAinfo reporter

Wesgro

Wesgro is the official investment and trade promotion agency for the Western Cape,

the first point of contact for foreign importers, local exporters and investors wanting

to take advantage of the business potential of Cape Town and the province as a

whole.

The agency works closely with key players such as the South African government,

business, labour, the City of Cape Town, district

municipalities and rural local

authorities. Its key objectives are:

Wesgro

Wesgro is the official investment and trade promotion agency for the Western Cape,

the first point of contact for foreign importers, local exporters and investors wanting

to take advantage of the business potential of Cape Town and the province as a

whole.

The agency works closely with key players such as the South African government,

business, labour, the City of Cape Town, district

municipalities and rural local

authorities. Its key objectives are:

The Cape Town International Convention Centre, in the heart of the Western Cape capital (Image: CTICC)

The Cape Town International Convention Centre, in the heart of the Western Cape capital (Image: CTICC)

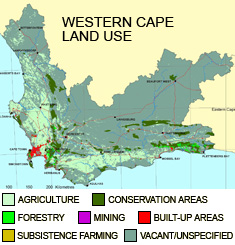

The Western Cape takes up 10.6% of South Africa's total land area (Image: Mary Alexander)

The Western Cape takes up 10.6% of South Africa's total land area (Image: Mary Alexander)

Map: Department of Environment and Tourism

Map: Department of Environment and Tourism