About South Africa

South Africa: even more fast facts

- South Africa's mineral wealth

- South Africa's automotive industry

- Financial services in South Africa

- South African media and film

- Outsourcing to South Africa

- South Africa's manufacturing sector

- South Africa's retail industry

- Visit South Africa

- South Africa's tourism industry

- Business tourism in South Africa

- South Africa's exciting cities

- South Africa: sporting paradise

- The adventure starts here

South Africa's automotive industry

South Africa's automotive industry is a global, turbo-charged engine for the manufacture and export of vehicles and components. The sector accounts for about 10% of South Africa's manufacturing exports, making it a crucial cog in the economy.

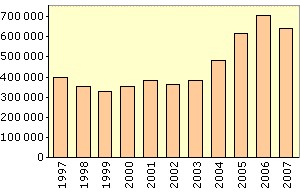

With annual production of 535 000 vehicles in 2007, expected to rise to 630 000 in 2008, South Africa can be regarded as a minor contributor to global vehicle production, which reached 73-million units in 2007.

But, locally, the automotive sector is a giant, contributing about 7.5% to the country's gross domestic product (GDP) and employing around 36 000 people.

South Africa has been one of the best performing automobile markets in the world in recent years. New vehicle sales figures soared to record-breaking levels for three years in succession, from 2004 to 2006. In 2006, sales increased by 14.4% to just under 650 000 units, generating revenue

of R118.4-billion.

Sales dropped by 5.4% in 2007, and are expected to drop further in 2008 as higher interest rates and rising prices curb spending.

Vehicle sales in South Africa

South Africa's automotive industry

South Africa's automotive industry is a global, turbo-charged engine for the manufacture and export of vehicles and components. The sector accounts for about 10% of South Africa's manufacturing exports, making it a crucial cog in the economy.

With annual production of 535 000 vehicles in 2007, expected to rise to 630 000 in 2008, South Africa can be regarded as a minor contributor to global vehicle production, which reached 73-million units in 2007.

But, locally, the automotive sector is a giant, contributing about 7.5% to the country's gross domestic product (GDP) and employing around 36 000 people.

South Africa has been one of the best performing automobile markets in the world in recent years. New vehicle sales figures soared to record-breaking levels for three years in succession, from 2004 to 2006. In 2006, sales increased by 14.4% to just under 650 000 units, generating revenue

of R118.4-billion.

Sales dropped by 5.4% in 2007, and are expected to drop further in 2008 as higher interest rates and rising prices curb spending.

Vehicle sales in South Africa

(Data source: National Association of Automobile Manufacturers of SA)

However, major export programmes are likely to keep the local industry buoyant. Vehicle exports were around 170 000 units in 2007, and the National Automobile Association of South Africa (Naamsa) expects this to jump to 285 000 in 2008. This is extraordinary growth, especially when compared to 1997, when the number of units exported was below 20 000.

All of the major vehicle makers are represented in South Africa, as well as eight of the world's top 10 auto component manufacturers and three of the four largest tyre manufacturers.

Between 2000 and 2006,

the industry's investment in production and export infrastructure quadrupled, from R1.5-billion to R6.2-billion, before slowing to R3-billion in 2007. Capital investment is expected to be around the R4-billion mark in 2008.

Most of this has been foreign investment, with the parent companies of local car manufacturers expanding local operations to improve production capacity, export facilities and supporting infrastructure.

All of the large manufacturers in the country have launched major export programmes in recent years - the latest (in January 2008) being Ford Motor Company of South Africa.

(Data source: National Association of Automobile Manufacturers of SA)

However, major export programmes are likely to keep the local industry buoyant. Vehicle exports were around 170 000 units in 2007, and the National Automobile Association of South Africa (Naamsa) expects this to jump to 285 000 in 2008. This is extraordinary growth, especially when compared to 1997, when the number of units exported was below 20 000.

All of the major vehicle makers are represented in South Africa, as well as eight of the world's top 10 auto component manufacturers and three of the four largest tyre manufacturers.

Between 2000 and 2006,

the industry's investment in production and export infrastructure quadrupled, from R1.5-billion to R6.2-billion, before slowing to R3-billion in 2007. Capital investment is expected to be around the R4-billion mark in 2008.

Most of this has been foreign investment, with the parent companies of local car manufacturers expanding local operations to improve production capacity, export facilities and supporting infrastructure.

All of the large manufacturers in the country have launched major export programmes in recent years - the latest (in January 2008) being Ford Motor Company of South Africa.

Financial services in South Africa

South Africa's monetary systems are robust and well-regulated, easily matching world

standards of sophistication

Offering commercial, retail and merchant banking, mortgage lending, insurance and investment, our financial sector is highly developed - and technologically advanced.

A range of complex electronic transactions are available through a vast network of automatic teller machines, via the internet, and on mobile phones.

Four of the country's 36 registered banks are rated among the world's top 500 financial institutions. In June 2006 all banks' total assets amounted to some R1.96-trillion. Banks are governed by the South African Reserve Bank, the central bank, which holds foreign reserves of US$24-billion.

The JSE Limited is South Africa's stock exchange, powering the country's economy. The exchange is the 16th-largest in the world by market capitalisation - some US$600-billion in June 2006.

With some 1 000 listed companies and securities, and a market liquidity of 47.8%, the JSE is larger than no fewer than nine exchanges officially classified

as "developed".

And it just keeps on growing. Trade on the JSE is booming, with the All Share Index rising nearly 70% from May 2005 to September 2006 - from some 13 000 points to a new record of over 22 000 points.

In July 2005 Barclays, Britain's third-biggest bank, concluded a R33-billion deal for 56,1% control of Absa, one of South Africa's top four banks. It's the biggest investment yet made in post-apartheid South Africa.

Mzansi, South Africa's innovative new low-cost banking scheme, provides banking services to more than 3.3-million low-income earners - a vast and growing market previously untapped by the financial sector.

Financial services in South Africa

South Africa's monetary systems are robust and well-regulated, easily matching world

standards of sophistication

Offering commercial, retail and merchant banking, mortgage lending, insurance and investment, our financial sector is highly developed - and technologically advanced.

A range of complex electronic transactions are available through a vast network of automatic teller machines, via the internet, and on mobile phones.

Four of the country's 36 registered banks are rated among the world's top 500 financial institutions. In June 2006 all banks' total assets amounted to some R1.96-trillion. Banks are governed by the South African Reserve Bank, the central bank, which holds foreign reserves of US$24-billion.

The JSE Limited is South Africa's stock exchange, powering the country's economy. The exchange is the 16th-largest in the world by market capitalisation - some US$600-billion in June 2006.

With some 1 000 listed companies and securities, and a market liquidity of 47.8%, the JSE is larger than no fewer than nine exchanges officially classified

as "developed".

And it just keeps on growing. Trade on the JSE is booming, with the All Share Index rising nearly 70% from May 2005 to September 2006 - from some 13 000 points to a new record of over 22 000 points.

In July 2005 Barclays, Britain's third-biggest bank, concluded a R33-billion deal for 56,1% control of Absa, one of South Africa's top four banks. It's the biggest investment yet made in post-apartheid South Africa.

Mzansi, South Africa's innovative new low-cost banking scheme, provides banking services to more than 3.3-million low-income earners - a vast and growing market previously untapped by the financial sector.

South African media and film

South Africa has a flourishing media, with a robust press, creative advertising,

television and radio, burgeoning internet publishing - and an Oscar-winning film industry

Locally produced movie Tsotsi won the Academy Award for best foreign-language film in 2006, having piled up audience awards at festivals across the world.

This followed on the Oscar nomination of Yesterday in 2004, a Golden Bear award for U-Carmen e-Khayelitsha at the Berlin film festival in 2005, a 2006 Bafta Television Award nomination for Red Dust, and major accolades for Son of Man at the 2006 Sundance film festival.

And it's not just local filmmakers that are boosting the industry. South Africa is becoming a favourite with international film and advertising companies, who are discovering the benefits of its low cost and diverse locations - from first-world cities to lush tropical forests, wide savannahs, desert landscapes and wild African bush.

The industry generated an estimated R2.5-billion in 2005, mostly through the production of

commercials.

South Africa's first major, Hollywood-style film studio aims to be making movies by early 2008. Dreamworld Film City, a R450-million complex in Cape Town, will not only boost the country's competitiveness in the global film industry - it will also serve as a catalyst for new development in some of the poorest areas around the city.

The complex has been designed as a Cape village, drawing inspiration from the streets and squares of the Western Cape, with a setting that strongly links it with the Cape magic of the mountains and winelands.

South Africa also has a free and flourishing press, with 20 daily and 13 weekly newspapers, and a range of news websites on a par with the best in the world.

South African television is broadcast in all 11 official languages, as well as in German, Hindi, Portugese - and even in sign.

There are an estimated 10-million radio sets in South Africa, with listeners many times that number, broadcasting in a multitude of

languages and with a range of programming from urban music to community news in the rural areas.

South African media and film

South Africa has a flourishing media, with a robust press, creative advertising,

television and radio, burgeoning internet publishing - and an Oscar-winning film industry

Locally produced movie Tsotsi won the Academy Award for best foreign-language film in 2006, having piled up audience awards at festivals across the world.

This followed on the Oscar nomination of Yesterday in 2004, a Golden Bear award for U-Carmen e-Khayelitsha at the Berlin film festival in 2005, a 2006 Bafta Television Award nomination for Red Dust, and major accolades for Son of Man at the 2006 Sundance film festival.

And it's not just local filmmakers that are boosting the industry. South Africa is becoming a favourite with international film and advertising companies, who are discovering the benefits of its low cost and diverse locations - from first-world cities to lush tropical forests, wide savannahs, desert landscapes and wild African bush.

The industry generated an estimated R2.5-billion in 2005, mostly through the production of

commercials.

South Africa's first major, Hollywood-style film studio aims to be making movies by early 2008. Dreamworld Film City, a R450-million complex in Cape Town, will not only boost the country's competitiveness in the global film industry - it will also serve as a catalyst for new development in some of the poorest areas around the city.

The complex has been designed as a Cape village, drawing inspiration from the streets and squares of the Western Cape, with a setting that strongly links it with the Cape magic of the mountains and winelands.

South Africa also has a free and flourishing press, with 20 daily and 13 weekly newspapers, and a range of news websites on a par with the best in the world.

South African television is broadcast in all 11 official languages, as well as in German, Hindi, Portugese - and even in sign.

There are an estimated 10-million radio sets in South Africa, with listeners many times that number, broadcasting in a multitude of

languages and with a range of programming from urban music to community news in the rural areas.

Outsourcing to South Africa

As global borders fall to new technology, South Africa is becoming the country of choice for global companies to outsource their business processes

Services such as call centres, help desks and accounts and claims processing can be made more efficient with South Africa's world-class service levels, time-zone and cultural compatibility with Europe, excellent English fluency (with a neutral accent), favourable exchange rate, sophisticated financial systems and advanced telecoms.

Coupled with skilled labour costs at two-thirds of those in the US or UK, these advantages make us strong contenders in global outsourcing. South Africa is giving India and the

Philippines a run for their money in servicing US, British and other markets.

For global firms, South Africa slots in between close locations such as Canada, Mexico or Eastern Europe, with cultural affinity to domestic markets, and more traditional offshore locations such as India and the Philippines, which offer cheap labour.

In late 2004 independent analysts Datamonitor predicted that South African call centre numbers would double by 2008 - and rated Cape Town ahead of India for quality of service.

The company estimates that there would be 939 call centres in South Africa by 2008, almost double the number of 494 in 2003.

In 2005 South Africa was ranked ahead of India, Mexico and the Philippines in an Ion Group poll of top UK companies' ideal offshore location.

In February 2006 leading UK telecoms firm TalkTalk announced plans to spend R200-million setting up two call centres - in Cape Town and Johannesburg - in the South African call-centre industry's biggest

foreign investment yet.

The Western Cape alone has secured call centre deals worth R933-million since the beginning of 2004, with investments in 2005 up by 19% over 2004. Companies running call centres in the Western Cape include Barclays, JP Morgan, Lufthansa, the Budget Group, Merchants/Asda, Dialogue and STA Travel.

World fuel giant Royal Dutch Shell is to set up one of its global super customer service centres (super-SCSs) in Cape Town. The centre will be one of a handful globally, providing customer services and credit management support to its international business customers.

The South African government's accelerated growth strategy has identified outsourcing as one of two priority sectors (the other is tourism) with exceptional potential for expansion. The strategy aims to make South Africa the world's third-biggest outsourcing centre - after India and the Philippines - by 2008.

Outsourcing to South Africa

As global borders fall to new technology, South Africa is becoming the country of choice for global companies to outsource their business processes

Services such as call centres, help desks and accounts and claims processing can be made more efficient with South Africa's world-class service levels, time-zone and cultural compatibility with Europe, excellent English fluency (with a neutral accent), favourable exchange rate, sophisticated financial systems and advanced telecoms.

Coupled with skilled labour costs at two-thirds of those in the US or UK, these advantages make us strong contenders in global outsourcing. South Africa is giving India and the

Philippines a run for their money in servicing US, British and other markets.

For global firms, South Africa slots in between close locations such as Canada, Mexico or Eastern Europe, with cultural affinity to domestic markets, and more traditional offshore locations such as India and the Philippines, which offer cheap labour.

In late 2004 independent analysts Datamonitor predicted that South African call centre numbers would double by 2008 - and rated Cape Town ahead of India for quality of service.

The company estimates that there would be 939 call centres in South Africa by 2008, almost double the number of 494 in 2003.

In 2005 South Africa was ranked ahead of India, Mexico and the Philippines in an Ion Group poll of top UK companies' ideal offshore location.

In February 2006 leading UK telecoms firm TalkTalk announced plans to spend R200-million setting up two call centres - in Cape Town and Johannesburg - in the South African call-centre industry's biggest

foreign investment yet.

The Western Cape alone has secured call centre deals worth R933-million since the beginning of 2004, with investments in 2005 up by 19% over 2004. Companies running call centres in the Western Cape include Barclays, JP Morgan, Lufthansa, the Budget Group, Merchants/Asda, Dialogue and STA Travel.

World fuel giant Royal Dutch Shell is to set up one of its global super customer service centres (super-SCSs) in Cape Town. The centre will be one of a handful globally, providing customer services and credit management support to its international business customers.

The South African government's accelerated growth strategy has identified outsourcing as one of two priority sectors (the other is tourism) with exceptional potential for expansion. The strategy aims to make South Africa the world's third-biggest outsourcing centre - after India and the Philippines - by 2008.

South Africa's manufacturing sector

Manufacturing is a robust pillar of South Africa's economy, driving growth with a resilient potential to compete with the best in the world.

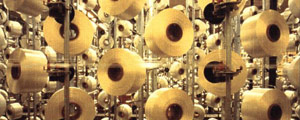

Diverse and sophisticated, the sector is dominated by the motor industry, textiles, metals beneficiation, chemicals, ICT and electronics, and agricultural processing.

South Africa's chemicals industry is the largest in Africa, contributing 5% to GDP and making up 25% of manufacturing sales. The country is also the world leader in coal-based synthesis and gas-to-liquids technologies.

South Africa is also set to be a world leader in renewable energy. Biofuels - clean fuels produced from renewable resources such as maize and soya - are the new big thing in the country's agriprocessing industry.

Growth in South Africa's

established and sophisticated ICT and electronics industry outstrips the world average. With more than 3 000 companies, the sector was ranked 22nd for world ICT spend in 2001.

The textile, clothing and footwear industry has been through a remarkable US$1-billion makeover since 1994, upgraded and modernised to deliver high-quality products to world markets.

Exports account for R1.4-billion for clothing and R2.5-billion for textiles, mostly to the US and Europe.

South African manufacturer Sans Fibres produces 80% of the world's apparel sewing thread. Local company Gelvenor Textiles makes 50% of the world's parachute fabric, and top-class manufacturer House of Monatic recently delivered its one-millionth suit to the United Kingdom market.

Agriculture - inputs, farming and agriprocessing - contributes R124-billion to South Africa's GDP, with R17.2-billion in processed products exported in 2001.

Farming has long been the country's lifeblood. Our sophisticated

infrastructure, rich biodiversity and marine resources, competitive input costs and southern hemisphere seasons (think summer fruit in the European winter) make us a major player on the world's agricultural markets - and a lucrative investment destination.

South Africa's manufacturing sector

Manufacturing is a robust pillar of South Africa's economy, driving growth with a resilient potential to compete with the best in the world.

Diverse and sophisticated, the sector is dominated by the motor industry, textiles, metals beneficiation, chemicals, ICT and electronics, and agricultural processing.

South Africa's chemicals industry is the largest in Africa, contributing 5% to GDP and making up 25% of manufacturing sales. The country is also the world leader in coal-based synthesis and gas-to-liquids technologies.

South Africa is also set to be a world leader in renewable energy. Biofuels - clean fuels produced from renewable resources such as maize and soya - are the new big thing in the country's agriprocessing industry.

Growth in South Africa's

established and sophisticated ICT and electronics industry outstrips the world average. With more than 3 000 companies, the sector was ranked 22nd for world ICT spend in 2001.

The textile, clothing and footwear industry has been through a remarkable US$1-billion makeover since 1994, upgraded and modernised to deliver high-quality products to world markets.

Exports account for R1.4-billion for clothing and R2.5-billion for textiles, mostly to the US and Europe.

South African manufacturer Sans Fibres produces 80% of the world's apparel sewing thread. Local company Gelvenor Textiles makes 50% of the world's parachute fabric, and top-class manufacturer House of Monatic recently delivered its one-millionth suit to the United Kingdom market.

Agriculture - inputs, farming and agriprocessing - contributes R124-billion to South Africa's GDP, with R17.2-billion in processed products exported in 2001.

Farming has long been the country's lifeblood. Our sophisticated

infrastructure, rich biodiversity and marine resources, competitive input costs and southern hemisphere seasons (think summer fruit in the European winter) make us a major player on the world's agricultural markets - and a lucrative investment destination.

South Africa's retail industry

South Africans love to shop - and to sell. Our wholesale and retail sales sector is cashing in on a sustained spending spree by the country's increasingly prosperous consumers

Shopping centres are everywhere. Some are so huge they'll give you a good day's hike from one end to the other. In Johannesburg there's Eastgate and Cresta, among others, and just outside Durban the mammoth Gateway Shopping Centre offers 150 000 square metres of shopping - that's

over 37 acres.

A rise in the spending power of black consumers is boosting key retail sectors. A 2004 report by the Financial Mail says motor vehicles, furniture, clothing, media, property and cellphone retailers are all benefiting from South Africa's new "buppy" class. And in the second quarter of 2006 the wholesale and retail trade, hotels and restaurants sector grew by 6.1%, contributing around 1% to GDP.

Wholesale and retail sales in South Africa

South Africa's retail industry

South Africans love to shop - and to sell. Our wholesale and retail sales sector is cashing in on a sustained spending spree by the country's increasingly prosperous consumers

Shopping centres are everywhere. Some are so huge they'll give you a good day's hike from one end to the other. In Johannesburg there's Eastgate and Cresta, among others, and just outside Durban the mammoth Gateway Shopping Centre offers 150 000 square metres of shopping - that's

over 37 acres.

A rise in the spending power of black consumers is boosting key retail sectors. A 2004 report by the Financial Mail says motor vehicles, furniture, clothing, media, property and cellphone retailers are all benefiting from South Africa's new "buppy" class. And in the second quarter of 2006 the wholesale and retail trade, hotels and restaurants sector grew by 6.1%, contributing around 1% to GDP.

Wholesale and retail sales in South Africa

(Data source: Statistics South Africa)

Retail is dominated by Woolworths, Shoprite, Cashbuild, Truworths and Massmart, giant companies profiting from the local boom and with operations spreading across the African continent.

In South Africa, Massmart plans to spend R400-million on 19 new stores, while Cashbuild is to boost its stores by

about 10 a year. Truworths has raised its capital expenditure by nearly R34-million and wants to increase its trading space by about 13%.

Food and clothing retailer Woolworths has set aside an additional R109-million to expand and modernise its stores. At the same time, Shoprite is to spend R800-million on capital projects.

South African retailers have invested heavily in high-tech electronic systems, allowing them to efficiently control stock and monitor trading density.

South Africans spent R514-million on internet shopping in 2005, 20% more than in 2004, according to tech-watchers World Wide Worx ... and this excludes the R1.8-billion online airline sales contributed to domestic e-commerce in 2005.

SAinfo reporter

(Data source: Statistics South Africa)

Retail is dominated by Woolworths, Shoprite, Cashbuild, Truworths and Massmart, giant companies profiting from the local boom and with operations spreading across the African continent.

In South Africa, Massmart plans to spend R400-million on 19 new stores, while Cashbuild is to boost its stores by

about 10 a year. Truworths has raised its capital expenditure by nearly R34-million and wants to increase its trading space by about 13%.

Food and clothing retailer Woolworths has set aside an additional R109-million to expand and modernise its stores. At the same time, Shoprite is to spend R800-million on capital projects.

South African retailers have invested heavily in high-tech electronic systems, allowing them to efficiently control stock and monitor trading density.

South Africans spent R514-million on internet shopping in 2005, 20% more than in 2004, according to tech-watchers World Wide Worx ... and this excludes the R1.8-billion online airline sales contributed to domestic e-commerce in 2005.

SAinfo reporter

Would you like to use this article in your publication

Would you like to use this article in your publicationor on your website?

See: Using SAinfo material