More freedom in SA's economy

4 October 2005

South Africa's economy is free! In an international ranking of market freedom, the country has risen six places to 38th out of 127 countries surveyed, with a score of 6.9 out of 10. Its previous ranking was 44th place.

The Economic Freedom of the World report, published each year by the Canadian Fraser Institute, is a composite score of 38 variables measuring the amount of economic freedom citizens have in various countries. This year's report, released in September, was based on 2003 data.

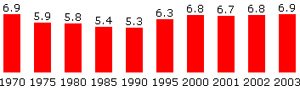

South Africa's economic freedom score out of 10: 1970 to 2003 (Image: Economic Freedom Network)

The report has been welcomed by the South African Free Market Foundation.

"The foundation has presented it to government - every minister gets a copy of the report," says Neil Emerick of the Free Market Foundation.

"It's one of those numbers that you’ve got to watch - like the Global Competitiveness Report and the International Corruption Report. This is certainly a report that a lot of international investors will be looking at."

South Africa's rise to 38th puts it ahead of such economies as France (38), Italy (54), Mexico (59), India (66), China (86), Brazil (88) and Russia (115).

"There might be Afro-pessimists who say we are behind in everything, but we're actually ahead of France in terms of economic freedom," Emerick says.

In this year’s index, Hong Kong retains the highest rating for economic freedom, 8.7 out of 10, closely followed by Singapore at 8.5. New Zealand, Switzerland and the US tie for third at 8.2. The bottom five countries are Myanmar, Zimbabwe, the Democratic Republic of Congo, Venezuela and Guinea-Bissau.

Wealth, happiness and

peace

The report reveals a strong correlation between economic freedom and a country's wealth. Those countries with higher levels of economic freedom are significantly wealthier than those with lower freedom scores. The free countries have better health, better education, better internet connectivity, and score highest on the happiness index.

The report has also found that economic freedom is almost 50 times more effective than democracy in diminishing violent conflict between nations.

"Researchers have long known democracies go to war about as often as other nations but tend not to go to war with each other," says James Gwartney, one of the report's authors.

"However, stable democracies typically have strong levels of economic freedom, leading to the question of whether it is democracy or economic freedom that affects the probability of violent conflict."

The score

The Economic Freedom of the World report

measures the degree to which the policies and institutions of countries are supportive of economic freedom. It ranks personal choice, voluntary exchange, freedom to compete and security of privately owned property as the cornerstones of this freedom.

Thirty-eight components are used to construct a summary index and measure the degree of economic freedom in five areas: size of government, legal structures and security of property rights, sound money, freedom to trade with foreigners, and regulation of credit, labour and business.

South Africa's strongest score is in the "access to sound money" category, at 8 out of 10. Inflation stability earned the country a whopping 9.6 out of 10, recent inflation 8.8 and growth of money supply 8.4, while freedom to own foreign currency was ranked at 5 out of 10 - up from 0 out of 10 in 1995.

The country scored 7.4 out of 10 for a regulatory environment allowing free trade with foreigners. This includes international trade taxes, trade barriers, the size of the trade sector and restrictions on capital markets. With no black market exchange rate, South Africa's score here was 10 out of 10 - up from 5 out of 10 in 1985, in the dying days of apartheid.

South Africa's full economic freedom ranking, with the 1995 position in brackets, is as follows. Ten is the highest possible score, and zero (0) the lowest.

Summary ratings (rank): 6.9 - 38th (6.3 - 48th)

Size of government: 5.6 (5.8)

Government consumption: 4.9 (4.5)

Transfers and subsidies: 8.8 (8.7)

Government enterprises & investment: 4.0 (6.0)

Top marginal tax rate: 4.5 (4.0)

Legal structure & security of property rights: 7.1 (6.1)

Judicial independence: 8.0 (7.2)

Impartial courts: 7.3 (7.9)

Protection of intellectual property: 6.7 (6.5)

Military interference: 8.3 (4.9)

Integrity of legal system: 5.0 (4.1)

Access to sound money: 8.0 (6.4)

Growth of money supply: 8.4 (8.2)

Inflation variability: 9.6 (9.3)

Recent annual inflation: 8.8 (8.2)

Freedom to own foreign currency: 5.0 (0.0)

Freedom to exchange with foreigners: 7.4 (6.3)

Taxes on international trade: 7.6 (5.5)

Regulatory trade barriers: 7.7 (6.4)

Size of trade sector: 6.5 (5.8)

Official versus black market exchange rate: 10.0 (10.0)

Restrictions on capital markets: 5.1 (4.0)

Regulation of credit, labour and business: 6.6 (6.8)

Regulation of credit markets: 8.8 (8.5)

Regulation of labour markets: 5.6 (6.1)

Regulation of business: 5.6 (5.9)

SouthAfrica.info reporter